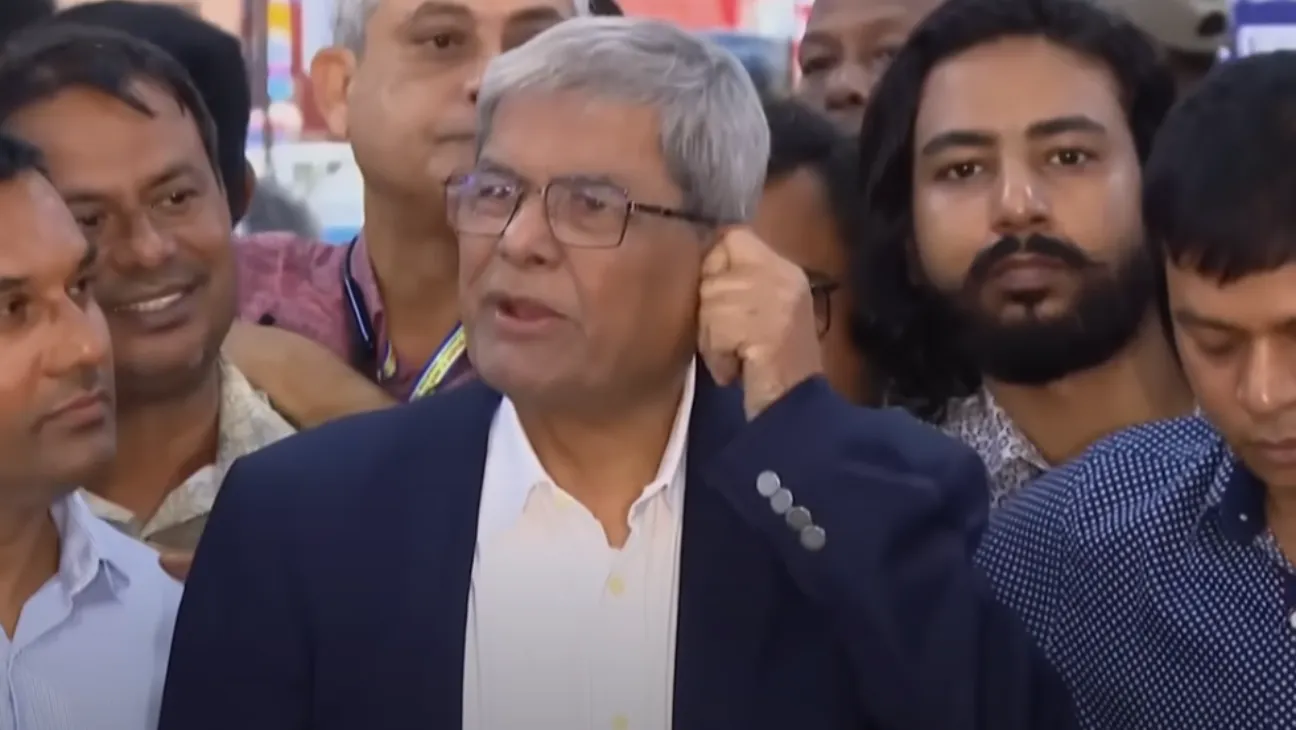

President Vladimir Putin was briefed Tuesday on troubling developments in financial crime during a meeting at the Kremlin with Yuri Chikhanchin, head of Russia’s financial monitoring agency, Rosfinmonitoring.

One of the most disturbing findings? Criminal networks are now involving children, including those as young as seven, to help move illegal money.

Widespread Use of Children Raises Alarm

Chikhanchin said that more than 50,000 websites are currently active in attracting individuals into financial scams, and minors have become a target group.

“Schoolchildren, even seven-year-olds, are being drawn in,” he said. “Criminals are using their school lunch payment cards, and from there, it escalates. These kids can end up involved in drug distribution, extremism, and terrorism.”

He made it clear the problem runs deep and wide. And it’s not just Rosfinmonitoring trying to fix it—they’ve got backup from some of the country’s most powerful bodies, like the FSB, the Interior Ministry, and the Investigative Committee.

Shutting Down Shadow Networks

Chikhanchin reported that Rosfinmonitoring now oversees about 90 percent of the country’s financial institutions, tracking everything from cryptocurrency transactions to international wire transfers.

Through joint operations with international partners, authorities have identified 50 shadow platforms used to launder stolen money. Over 100 criminal cases are now open.

“These platforms help criminals send money abroad. We’ve tracked the routes, the banks, the countries involved,” Chikhanchin said.

Action on Suspicious Banks and Fraud Rings

In 2024 alone, six banks had their licenses revoked due to suspicious activity. Officials say these actions prevented nearly 500 billion rubles from being funneled into the black market. Another 20 billion rubles in high-risk transactions were blocked.

Other steps include shutting down about 90 financial pyramids and phony brokerage services. Russia’s communications watchdog, Roskomnadzor, took down roughly 40,000 fraudulent websites.

Nearly 700,000 criminal bank accounts were frozen, and operations of 60 unlicensed lenders were stopped.

Focus on Government Contracts and Corruption

Rosfinmonitoring has also been watching state contracts more closely, especially those with only one bidder or contracts that see a price hike after approval.

Some cases involve officials using public money to purchase property or vehicles for personal use.

So far, 1,300 criminal investigations have been launched in connection with public procurement issues.

Authorities blocked illegal trades worth 39 billion rubles and preserved 27 billion rubles in government funds.

Drug Trafficking and Terror Funding Also Targeted

The agency is also monitoring drug networks and terrorist financing.

A recent operation dismantled a multinational drug ring involving 500 people and turnover of about 1 billion rubles. Last year alone, 250 million rubles intended for extremist or terrorist groups were frozen.

Currency Monitoring Sees Ruble Growth in Trade

Chikhanchin added that while Rosfinmonitoring is strict with violators, most Russian exporters are compliant.

He pointed to a noticeable increase in the use of the ruble in foreign trade transactions, describing the trend as significant.

“We are tracking currency flows as part of broader financial oversight,” he said.

The conversation in the Kremlin reflected growing concern about how quickly financial crime tactics are evolving. For Russia, the risks are no longer limited to offshore laundering or digital fraud — they now involve minors, public contracts, and domestic institutions, all under increasing scrutiny.