Bangladesh’s top officials are vowing to push through major economic reforms in the next eight months, though they concede it won’t be easy.

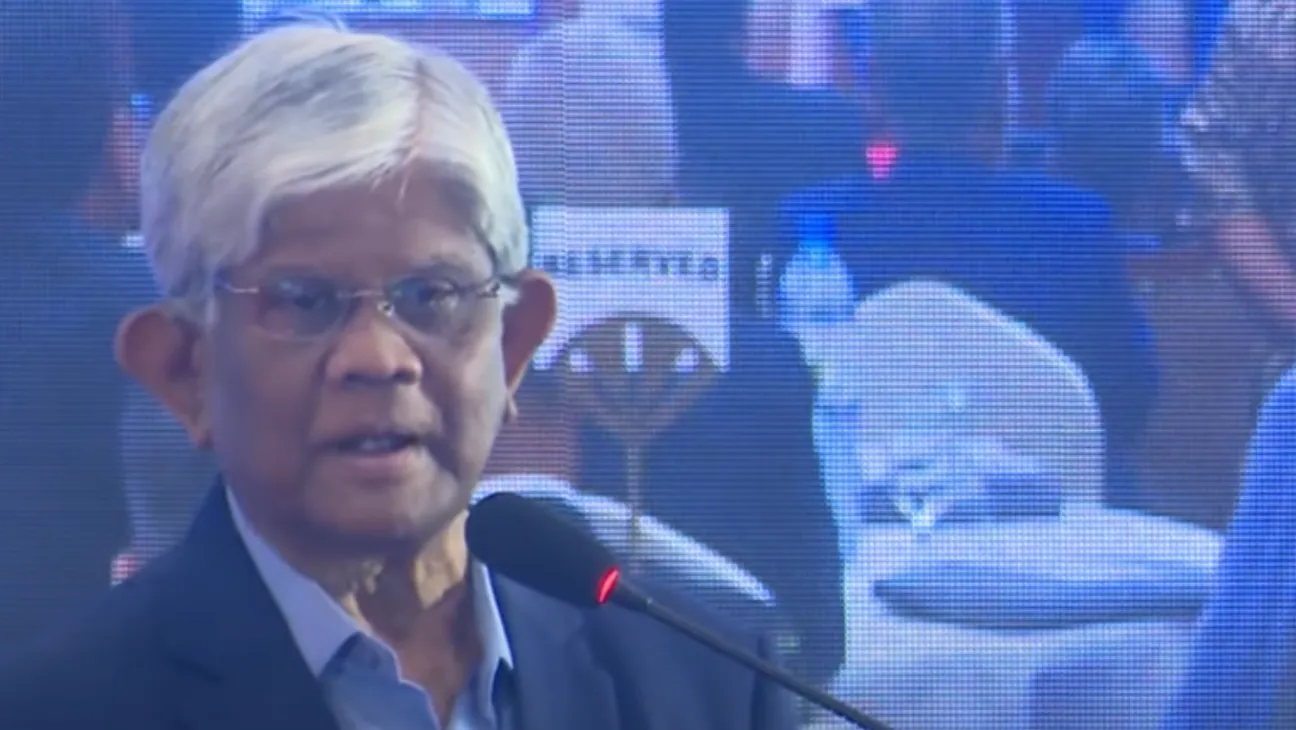

The promise was made Wednesday at a Dhaka summit co-hosted by the World Bank and the FRC. According to Economic Advisor Dr. Salehuddin Ahmed, the main goal is to clean up a financial system that was left in shambles by years of authoritarian rule.

“Reforms are never easy,” he told attendees. “But the Prime Minister is determined to push forward with key structural changes.”

According to Ahmed, the challenge now lies in making financial accounting systems more credible in order to rebuild trust with investors, particularly international lenders and donor agencies.

“The foreign partners expect accountability,” he said. “This effort isn’t for them alone. It’s for us.”

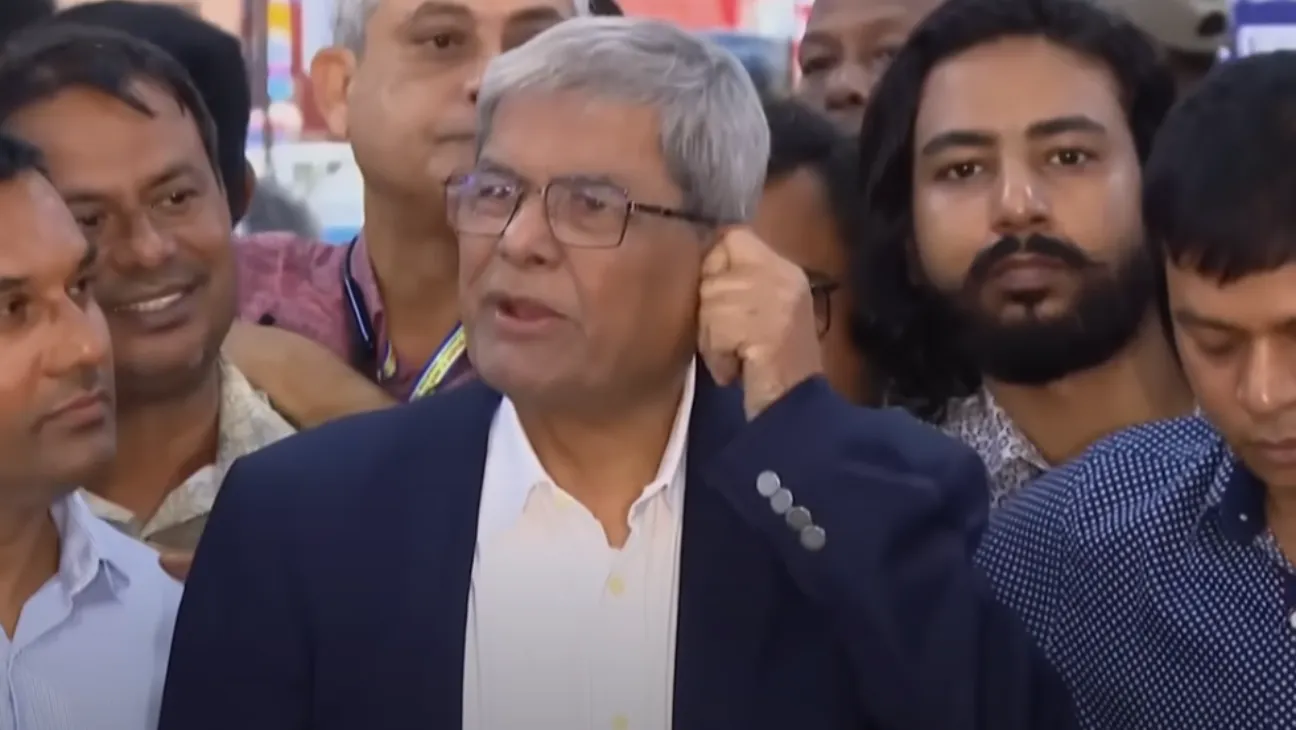

Central Bank Governor Abdur Rouf Talukder also addressed the audience. He acknowledged the depth of corruption in the banking sector and said it has placed regulators in a tough spot.

“The financial structure was left in ruins,” he said. “Now we are moving, slowly and carefully, toward rebuilding it.”

Talukder added that the Bangladesh Bank is working to enhance its legal authority and independence. A revision of the Bank Company Act is underway to strengthen the central bank’s autonomy.

He urged all regulatory agencies to collaborate on reviving institutions that have collapsed or are on the brink.

“Some of these institutions are barely functioning,” he said. “We need joint action to get them back on their feet.”

The summit took a sharper turn when Anti-Corruption Commission (ACC) Chairman Moinuddin Abdullah presented a case involving IFIC.

According to the ACC, businessman and politician Salman F Rahman allegedly misled investors through bond issuance, causing significant financial harm.

“This was not just mismanagement,” said Abdullah. “It was outright deception.”

The remarks follow growing concern from both domestic and international observers over the health of Bangladesh’s financial sector.

While pledges for reform have been made before, the timeline of seven to eight months offered by the government reflects an urgency that many hope will result in tangible outcomes.

Still, questions remain. Will institutional capacity and political will be enough to deliver what has been promised? That’s something the country’s investors—and its people—are watching closely.