U.S. President Donald Trump on Wednesday announced a sweeping 25% tariff on imports from India, citing the country’s continued purchase of Russian oil.

The move marks a serious downturn in U.S.-India relations, weeks after trade talks between the two governments collapsed. The new tariff, which takes effect 21 days after August 7, could double duties on some Indian products — pushing them as high as 50%.

Trump said the action was meant to penalize New Delhi for what he called “profiting” from discounted Russian oil while refusing to join sanctions efforts. He left open the possibility of similar measures against China.

“It may happen… I can’t tell you yet,” Trump told reporters. “We did it with India. We’re doing it probably with a couple of others. One of them could be China.”

India’s nearly $87 billion export relationship with the U.S. is facing a serious threat. Key industries like textiles, footwear, and jewelry are expected to be hit the hardest. The Federation of Indian Export Organisations is now warning that a staggering 55% of all shipments from India to the U.S. could be in jeopardy.

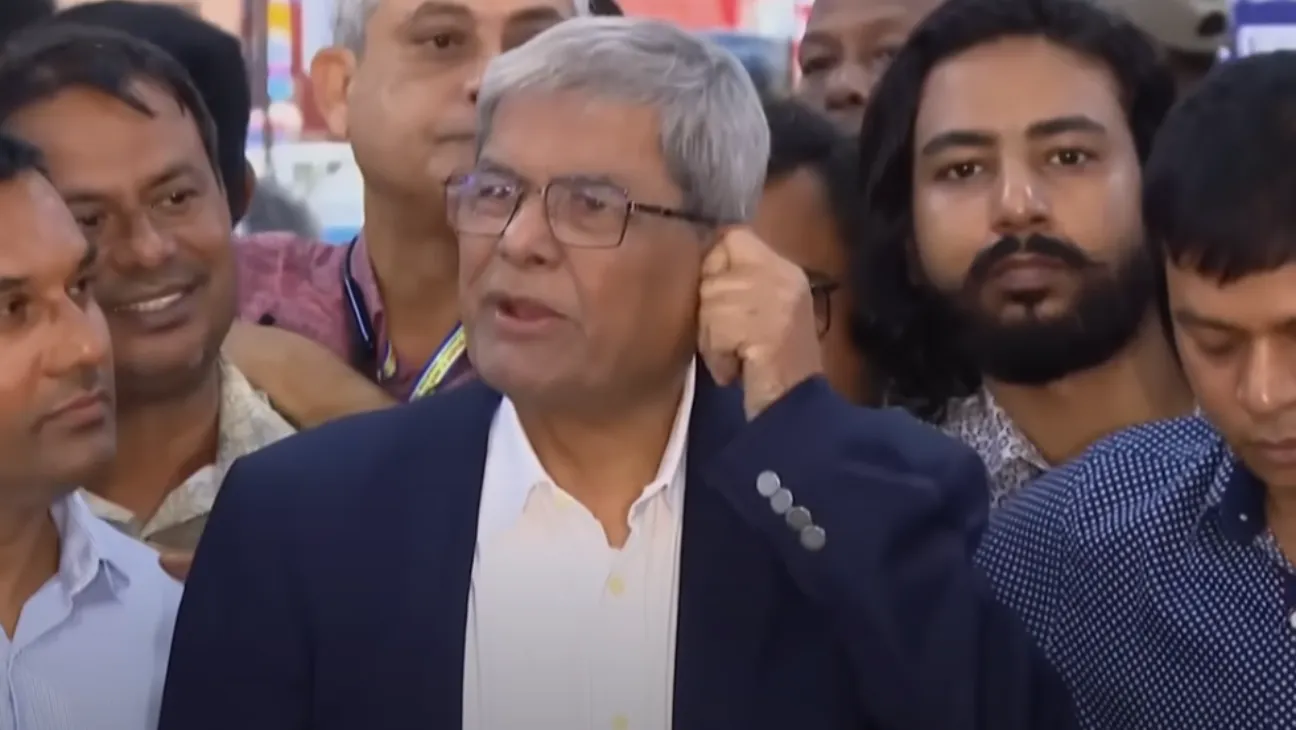

“This is a severe setback,” said S.C. Ralhan, the group’s president.

The Indian government called the decision “extremely unfortunate.” It said Russian oil purchases were driven by market pricing and the energy needs of its population.

“India will take all necessary steps to protect its national interests,” the foreign ministry said.

Some Indian officials hinted at room for compromise. While there are no current plans for retaliation or high-level meetings in Washington, internal discussions are underway to provide exporters with subsidies and credit relief.

“We still have a window,” said one senior official. “The fact that the new tariffs take effect in 21 days signals the White House is open to talks.”

The U.S. and India, the world’s largest and fifth-largest economies, share over $190 billion in annual trade. But five rounds of negotiations have failed in recent months.

Talks stalled over American demands for more access to Indian agricultural and dairy markets. Indian officials held firm, especially on maintaining oil imports from Russia, which hit $52 billion in 2024 — a record.

The breakdown in talks didn’t come out of nowhere. Officials from both sides admitted the collapse was partly driven by political missteps and misunderstandings.

At a campaign event in July, Trump referred to India’s economy as “dead” and said its trade barriers were “obnoxious.” He also accused India of ignoring Russia’s invasion of Ukraine. Those comments were seen in New Delhi as deliberately provocative.

Meanwhile, Indian Prime Minister Narendra Modi is preparing for his first visit to China in more than seven years — a sign, some say, that India may be rethinking its strategic alignment.

Markets responded quickly. Oil prices rose about 1% on Wednesday. India’s rupee slipped slightly in offshore trading. Indian stock futures edged down.

“Markets have already started pricing in the risk of a sharp tariff hike,” said Mayuresh Joshi, head of equity research at William O’Neil India. “But a knee-jerk reaction is inevitable unless there’s swift clarity.”

The tariff shock adds pressure to India’s slowing growth. Economists now warn the country’s GDP could fall below 6% this year, missing the Reserve Bank of India’s 6.5% forecast.

Some observers say Trump is using the tariffs to burnish his domestic manufacturing pitch — portraying the move as a way to reduce trade deficits. But analysts caution that the fallout could be long-term.

“With such obnoxious tariff rates, trade between the two nations would be practically dead,” said Madhavi Arora, an economist at Emkay Global.

With the 21-day fuse now lit, the question on everyone’s mind is simple: will India be the one to fold? Or are both sides just digging in for a long, bruising economic war of attrition?