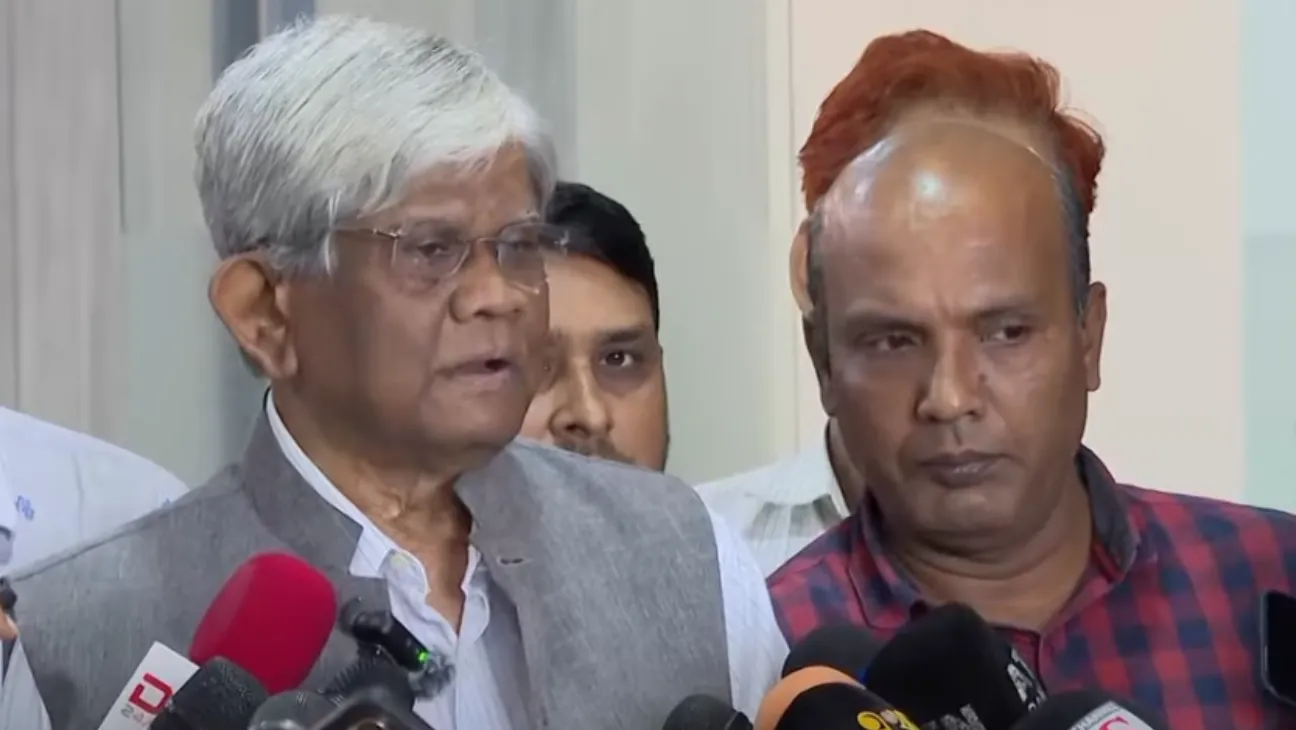

Finance Adviser Salehuddin Ahmed said on Tuesday that he is “more or less satisfied” with the National Board of Revenue’s (NBR) revenue collection for the 2024–25 fiscal year, describing the performance as moderate with no major shortfall.

His comments came after a meeting of the Cabinet Committee on Government Purchase held at the Secretariat in Dhaka.

Provisional Collection Falls Short of Target

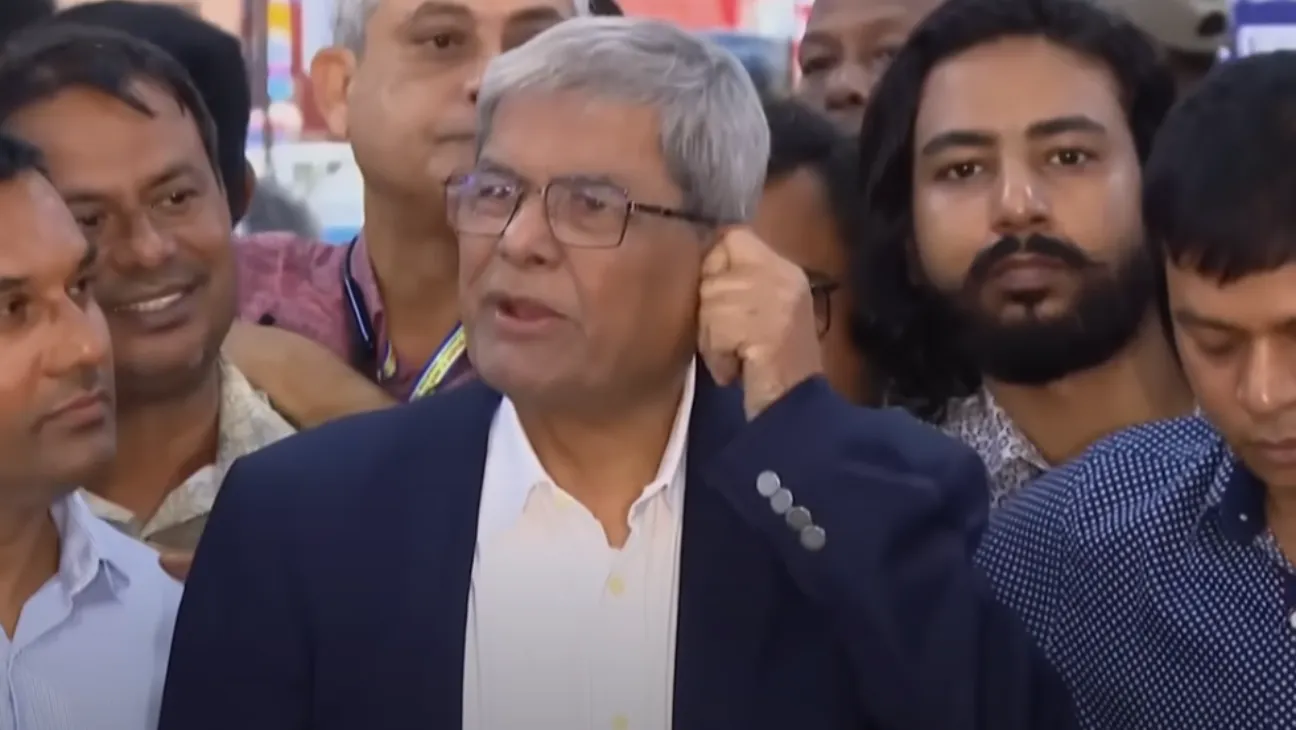

According to NBR Chairman Md Abdur Rahman Khan, the agency’s provisional revenue collection stands at Tk 3,68,177 crore for FY2024–25. This figure, shared during his visit to Dhaka Customs House on Monday, is expected to increase slightly after final calculations.

Despite the rise, it still falls short of the revised target of Tk 4,63,500 crore — and even further below the original Tk 4,80,000 crore goal.

Shifting Focus to Systemic Change

The finance adviser acknowledged the gap but said the government is prioritizing long-term structural changes in revenue collection instead of short-term tax pressure.

“There will be no leakage, no problem for the businessmen,” he told reporters.

He also pointed out that Bangladesh has a wide potential tax base that remains underutilized. “We failed to use it properly. That led to problems in revenue collection,” he added.

FY2025–26 Budget Sets Higher Target

Looking ahead, the national budget for FY2025–26 has set a total revenue collection target of Tk 5.64 lakh crore, which is around 9% of the country’s GDP.

Out of this amount, Tk 4.99 lakh crore is expected to come from the NBR. The rest, Tk 65,000 crore, is projected from non-NBR sources.

Breakdown of NBR’s collection targets for FY2025–26:

-

Taxes on income, profits and capital gains: Tk 1,82,001 crore

-

Value-added tax (VAT): Tk 1,88,518 crore

-

Supplementary tax: Tk 68,244 crore

-

Import duty: Tk 51,438 crore

-

Export duty: Tk 78 crore

-

Excise duty: Tk 6,091 crore

-

Other taxes: Tk 2,630 crore

Balancing Reform with Business Confidence

Salehuddin stressed that the upcoming approach will avoid putting stress on businesses while still targeting better compliance and reduced leakage.

The shift points to a government push for efficiency rather than volume, even as revenue goals climb. Whether the reforms will achieve that is still uncertain.