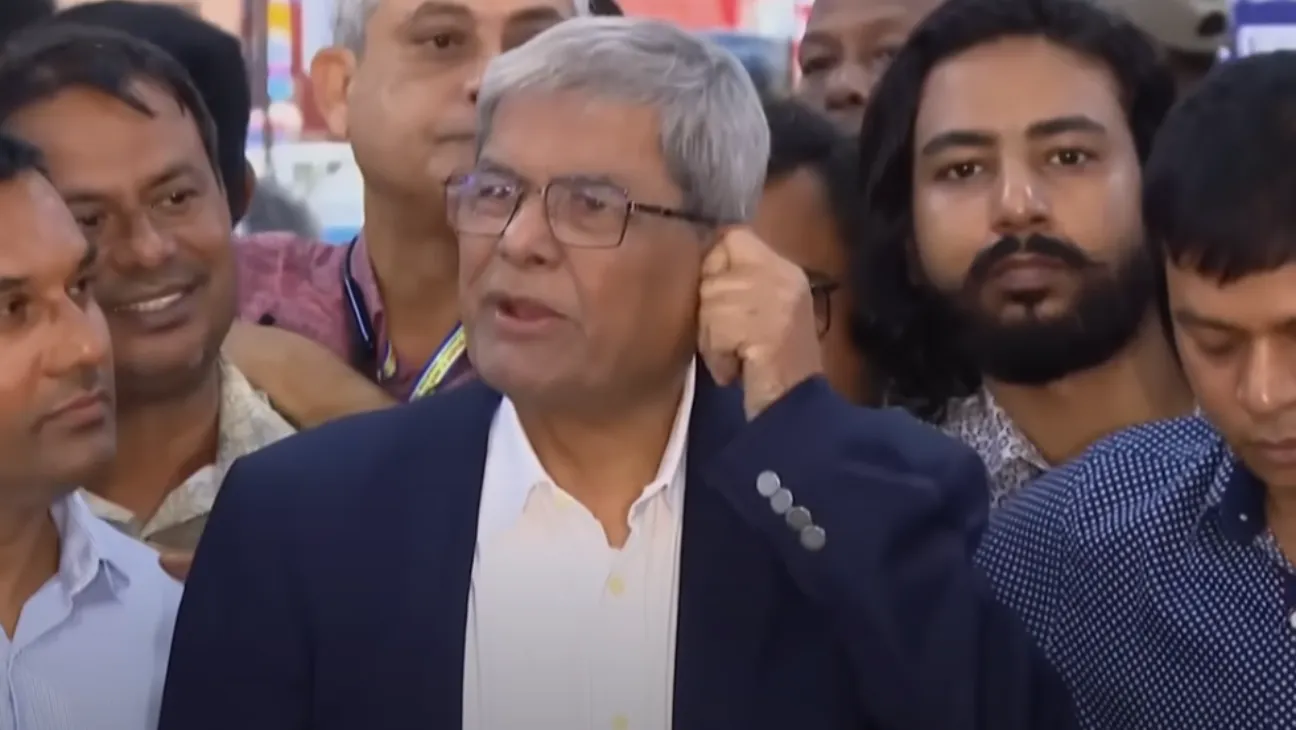

Bangladesh Bank Governor Dr Ahsan H Mansur has voiced serious concerns over the judiciary’s impact on the country’s financial sector, warning that without reform, recovery will remain elusive.

In a recent interview with a local news outlet, Dr Mansur said the central bank is preparing to revise the Artha Rin Adalat Ain, or Money Loan Courts Act, to improve loan recovery mechanisms.

A Judicial Barrier to Financial Stability

“If the judiciary continues on its current path, the financial sector will never be able to rebound,” the governor said.

He stressed that Bangladesh Bank, the government, and the judiciary must work in unison. “To meet international standards, our institutions must operate with equivalent capacity and accountability.”

At the core of his concern is how legal interventions, particularly stay orders from higher courts, interfere with the classification and pursuit of loan defaulters.

“A defaulter should be called a defaulter,” he said. Even when borrowers manage to secure stay orders, Mansur believes banks should not be prevented from classifying them appropriately.

“The way a bank understands a customer, the court simply cannot match that insight,” he added.

A Recent Case as a Policy Example

Mansur pointed to a recent incident involving Agrani Bank, where a borrower was still declared a defaulter despite having obtained a High Court stay order. A warrant was later issued. The governor described the decision as “policy-wise correct.”

The case highlights the tension between legal rulings and banking oversight, a conflict Mansur believes is hampering financial discipline.

Deeper Troubles in the Banking Sector

Reflecting on the past year’s efforts to restructure the banking system, Mansur indicated the problems run deeper than many anticipated.

“This didn’t start yesterday. Banks and financial institutions have been systematically seized over the past eight or nine years,” he said.

He accused those responsible of methodically laundering money and described the banking sector as a “honeypot” that was exploited without regard for depositors.

“No one thought about protecting the safety of public deposits,” Mansur said. “Instead, it became a sector for looting.”

Allegations of Complicity

Mansur didn’t stop at criticism of bad actors. He alleged that the misuse of banks occurred in full view of both the government and Bangladesh Bank, with little resistance.

“In many cases, the concerned authorities even assisted those groups,” he claimed.

He recalled warning a former central bank governor about the risk posed by a particular figure. “I directly told him, ‘Be careful about Mr X.’ Because if he hijacks the banks, the entire sector will collapse.”

The governor said his warnings were not taken seriously.

A System on the Brink

Mansur closed the interview with a grim analogy. “I then said, if several banks fall at once, we will even need ambulances. Unfortunately, that’s exactly what happened.”

He argued that the banking system had effectively been “handed over to one family and opened up for looting.”

As the central bank prepares legal revisions and contemplates broader restructuring, Mansur’s comments reveal not only frustration, but a growing urgency.

The financial sector may be at a tipping point—and without coordinated reform, recovery might not come soon.