Bangladesh has set a higher agricultural loan target for the 2025–26 fiscal year, aiming to strengthen food security and increase investment in farming.

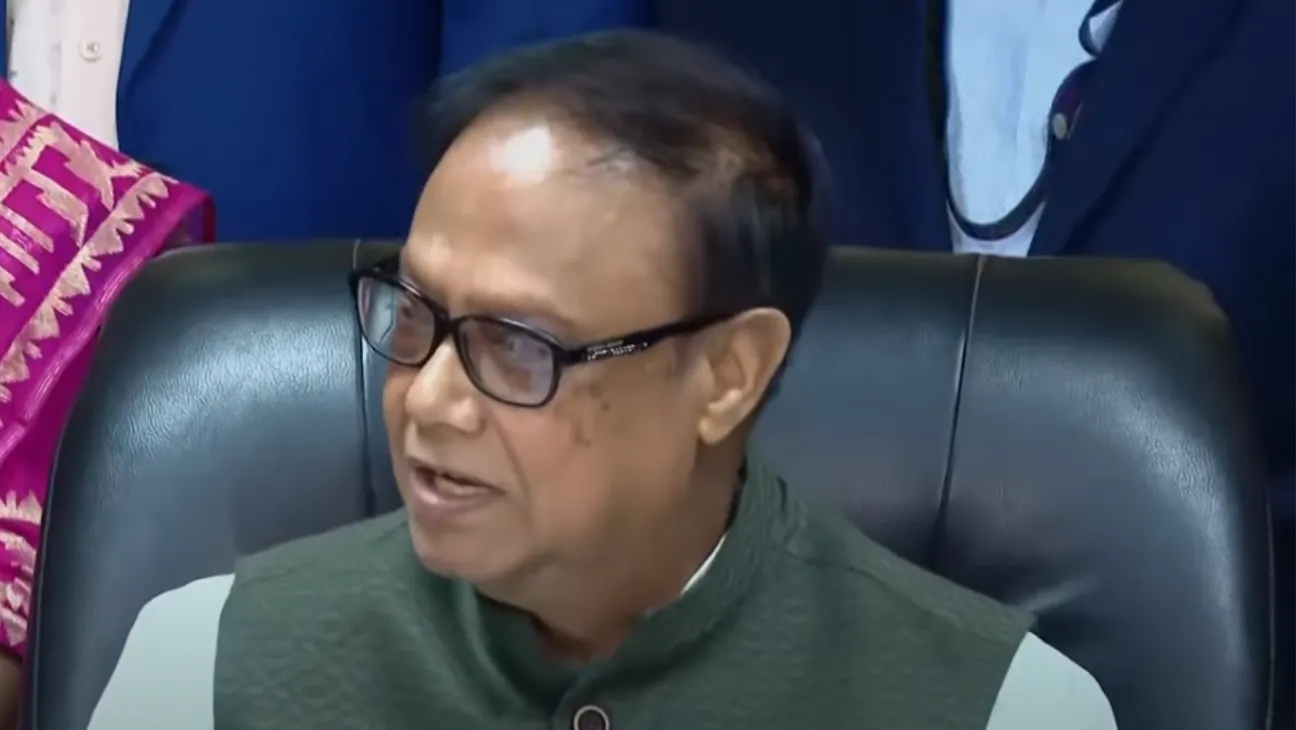

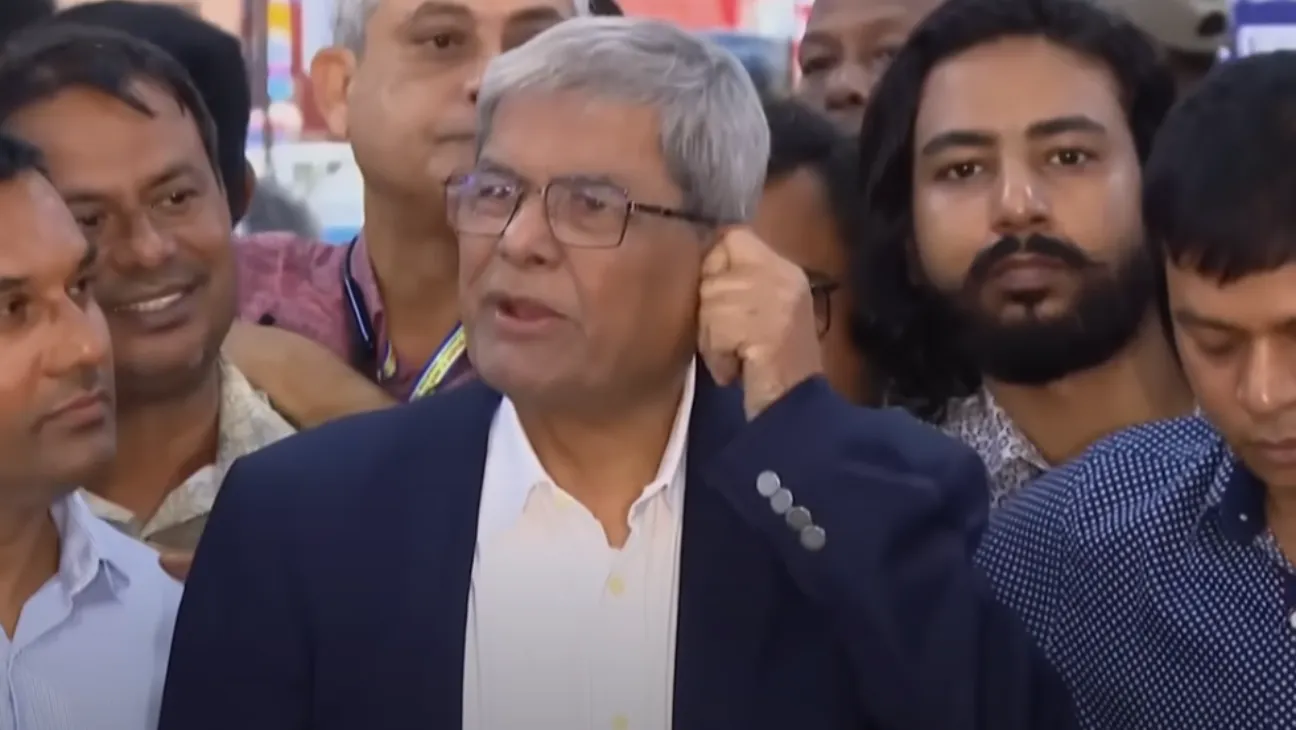

On Tuesday, Bangladesh Bank Governor Dr Ahsan H Mansur announced the new target of Tk39,000 crore under the Agricultural and Rural Credit Policy and Program. That’s up 2.63% from last year’s Tk38,000 crore.

The announcement came at an event attended by senior officials, including the Director of the Agricultural Credit Department and heads of several commercial banks.

The central bank is raising its targets to get more credit flowing into rural areas. Officials say this is essential for supporting farmers and ensuring the country has a stable food supply. They also believe the policy can help keep inflation under control and create new jobs.

Several changes have been made to the policy.

- The livestock sector’s allocation rises to 20% of the total target.

- Irrigation and agricultural machinery will receive 2%.

- Loans of up to Tk 2,50,000 will be exempt from CIB service charges.

- Contract farming and agent banking will be expanded.

- New crops have been added to the loan-eligible list, including cucumber, taro stem, beetroot, black cumin, ginger, garlic, turmeric, and date molasses.

- Banks will be directed to disburse loans based on regional production potential.

Speaking about the revisions, Dr Mansur said these steps were meant to make credit more accessible and responsive to farmers’ needs.

Don’t let the small percentages fool you. For a farmer, getting their hands on even a little bit of cash can be a game-changer. It’s what decides if they can plant more crops or have to start downsizing. And with the cost of everything going up, that loan isn’t just a bonus—it’s a lifeline.

The central bank believes that by giving more loans to farmers, we’ll see more food being grown. The goal is to lower grocery prices and build a stronger, more stable economy.