Confidence in Bangladesh’s market is on the rise, all thanks to the upcoming national election. This was the key takeaway from the Foreign Investors Summit 2025 held in Dhaka on Wednesday.

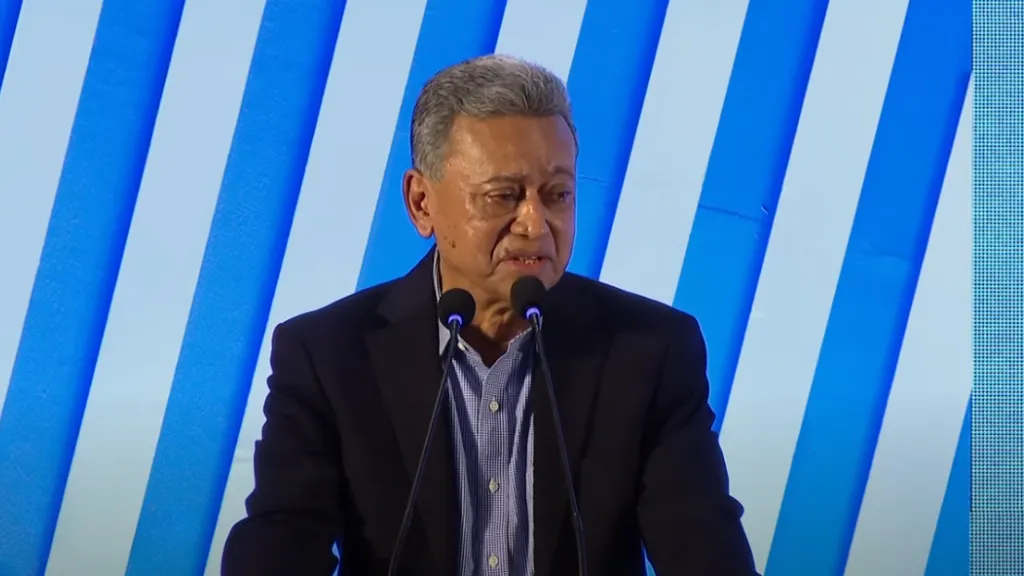

Amir Khasru Mahmud Chowdhury of the BNP Standing Committee explained that the election announcement has calmed investors’ nerves. Now, he sees companies both in Bangladesh and overseas gearing up for new projects.

“The news has reached entrepreneurs at home and abroad,” he noted during a panel on the economy. “We can see the interest building.”

He pointed to a large Japanese business delegation present at the event as an example of growing engagement. For sustained growth, Khasru argued, Bangladesh must focus on expanding investment rather than depending on loans or printing money. He said a stronger capital market is essential for financing development over the long term.

That means, he added, improving product branding, offering technical and economic support, and ensuring investors can directly reach global markets.

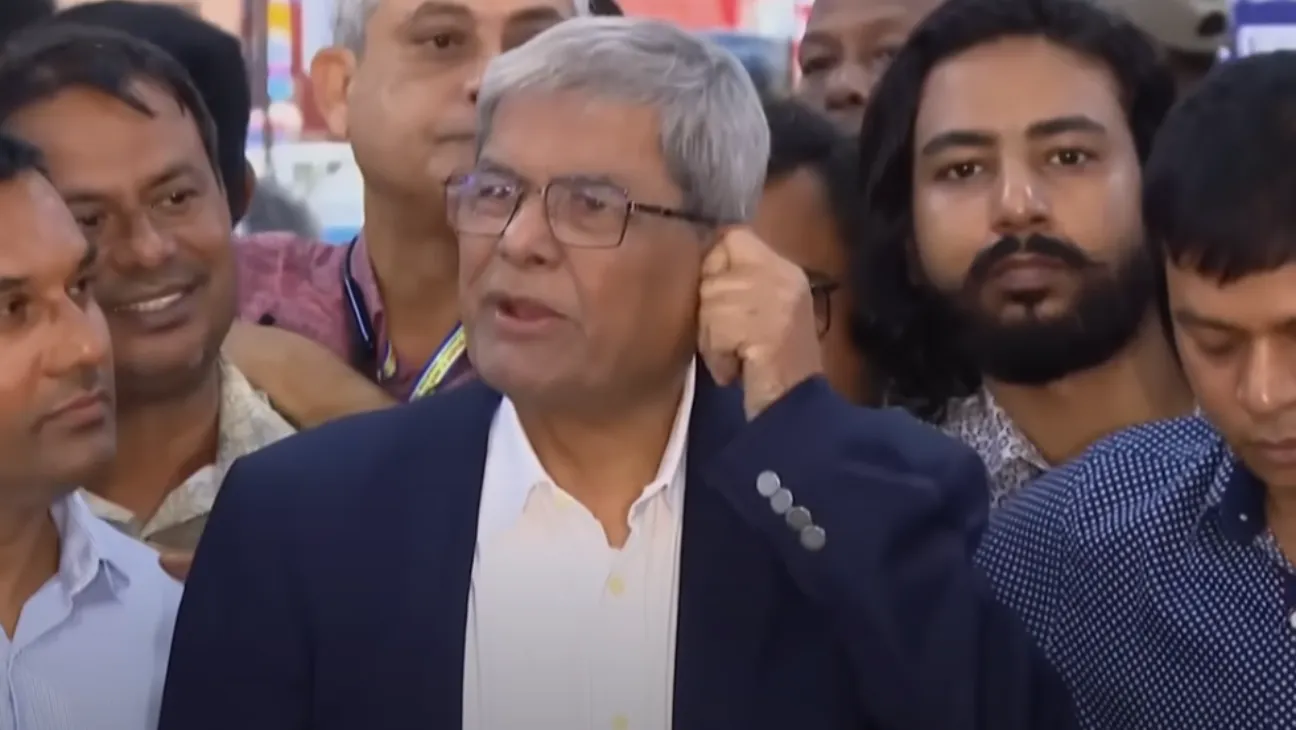

In the summit’s opening session, Anisuzzaman Chowdhury, special assistant to the chief adviser for finance, said Bangladesh had avoided the economic turmoil that often follows political change in other countries.

Also Read: Finance Adviser Says Loan Defaulters Will Be Barred from 2026 Bangladesh Election

Despite a recent mass uprising and change of government, GDP has held steady and inflation has fallen, which he called a “miraculous achievement.” He pointed to the capital market’s rebound as further evidence of stability.

Last month, Bangladesh ranked third among Asian countries for stock market performance, a sharp turnaround for a market once criticized for irregularities. Anisuzzaman said the interim government is committed to building a transparent, well-governed capital market.

“This is a great time to invest,” he told participants, noting that the market is prepared for long-term commitments.

Brac EPL Stock Brokerage really pulled out all the stops for the summit, gathering an impressive list of speakers. We heard from top figures in both finance and government, including the Bangladesh Securities and Exchange Commission and key investment groups.

The room was packed with a global mix of investors and policymakers, and you could just feel the energy. It goes to show how much the world is watching to see what Bangladesh does next.