President Donald Trump on Monday said the United States and India are close to reaching a long-awaited trade agreement. But within a day, he added a warning: India could face a 10% tariff if it stays aligned with the BRICS economic bloc, which he accused of undermining the US dollar.

“We’ve made a deal with the United Kingdom, we’ve made a deal with China, we’re close to making a deal with India,” Trump told reporters during a meeting with Israeli Prime Minister Benjamin Netanyahu.

His comments came as the US released a list of 14 countries facing new tariffs starting August 1. India was not on that list. That absence, according to trade analysts, suggests the two nations may have made meaningful headway behind closed doors, despite several sticking points.

Yet speaking the next morning, Trump shifted tone. Asked directly whether India would face tariffs under his new BRICS-focused trade policy, he didn’t hesitate.

“They will certainly have to pay 10% if they are in BRICS,” Trump said. “Because BRICS was set up to hurt us, to degenerate our dollar. The Dollar is king. We’re going to keep it that way.”

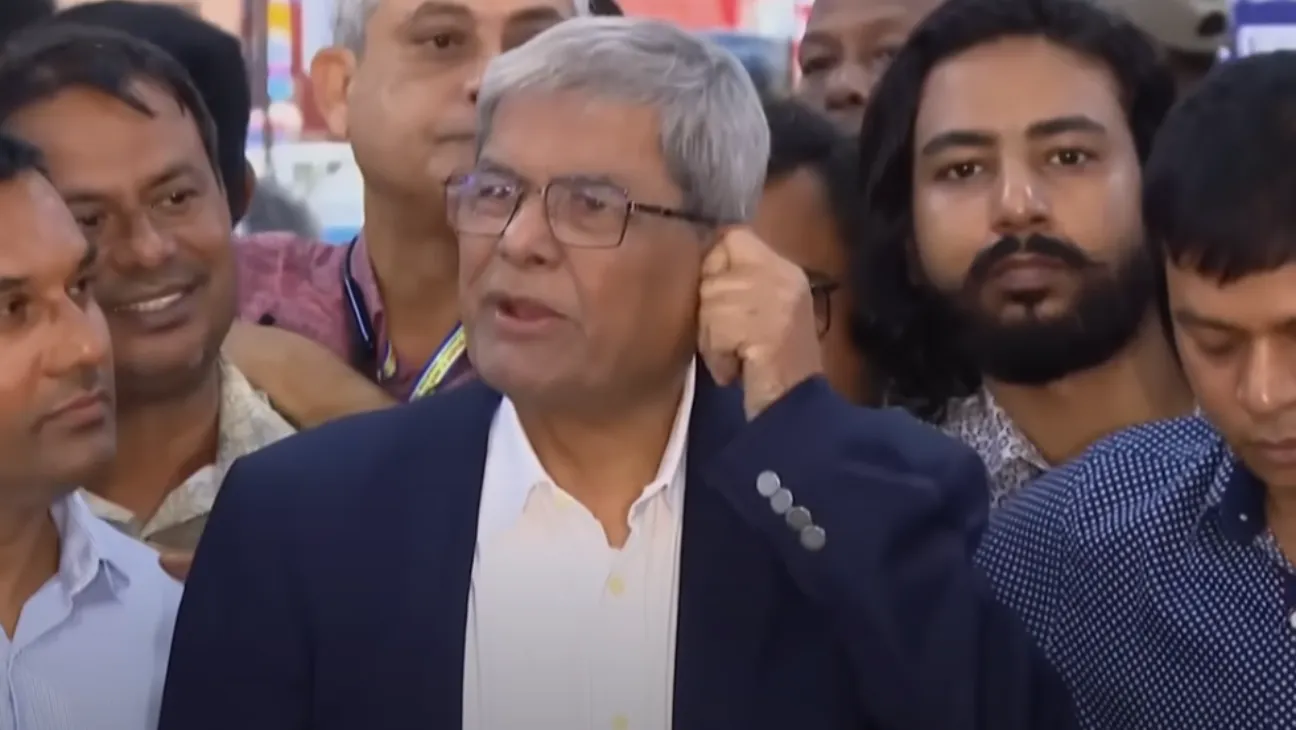

The statement came days after Rajesh Agrawal and his team returned from Washington. Though discussions with the US Trade Representative ended without a deal, they reportedly narrowed differences on key trade matters.

Points of Contention Remain

Several of the disagreements between Washington and New Delhi have been consistent. Chief among them is agriculture. The US wants broader access for American agricultural goods. India is reluctant.

Indian officials say the push affects millions of rural families, many of whom depend on small-scale dairy and crop farming. Genetically modified imports like corn and soybean are also banned under Indian law, and dairy imports face religious and dietary hurdles.

Despite that, experts say India’s exclusion from the latest tariff list signals that talks have moved forward.

Mark Linscott, a former US Trade Representative official, said both governments likely reached “an agreement in principle” that allows them to present a partial win without full ratification.

“This one could go further than the agreements we’ve seen with the UK and Vietnam,” Linscott said, predicting improvements on tariff reductions, market access, and non-tariff barriers.

Trade Pressure on Multiple Fronts

India’s government had also been applying pressure of its own. On July 3, it filed a 30-day notice with the World Trade Organization, signaling it might suspend trade concessions on American goods. The move follows a years-long dispute over US steel and aluminum tariffs.

Commerce Minister Piyush Goyal said India would not rush any deal.

“We never negotiate trade deals with a deadline,” he told reporters last week. “National interest should always be supreme.”

India argues that the US tariffs have affected $7.6 billion worth of Indian exports and brought in nearly $2 billion in duties for the US.

Trump’s administration had initially imposed a 10% global tariff on April 2, known as the “Liberation Day” tariffs, with country-specific rates added on top. India faced a potential 26% total levy until the White House paused enforcement for 90 days. That pause now runs until August 1.

ALSO READ: US Tariffs Cut Still Pushes Total Duty on Bangladeshi Exports Above 50%

A Bigger Goal in Sight

This could be a huge deal—the first formal trade agreement between the two nations in nearly two decades. Things really kicked off again back in February when Prime Minister Narendra Modi made a trip to Washington.

At the time, they agreed on a tight deadline, aiming to lock in the first stage of the agreement by September. On top of that, they set their sights on a massive goal: doubling their two-way trade to $500 billion by 2030.

For now, though, that future depends on how India navigates the latest warning from Trump. BRICS membership may carry unexpected economic costs if Washington decides to link it to tariff penalties.

The coming weeks could be pivotal. The US election campaign is ramping up. India is seeking favorable market access. And both governments are under pressure to deliver something concrete. Whether the dollar dispute derails the deal remains to be seen.