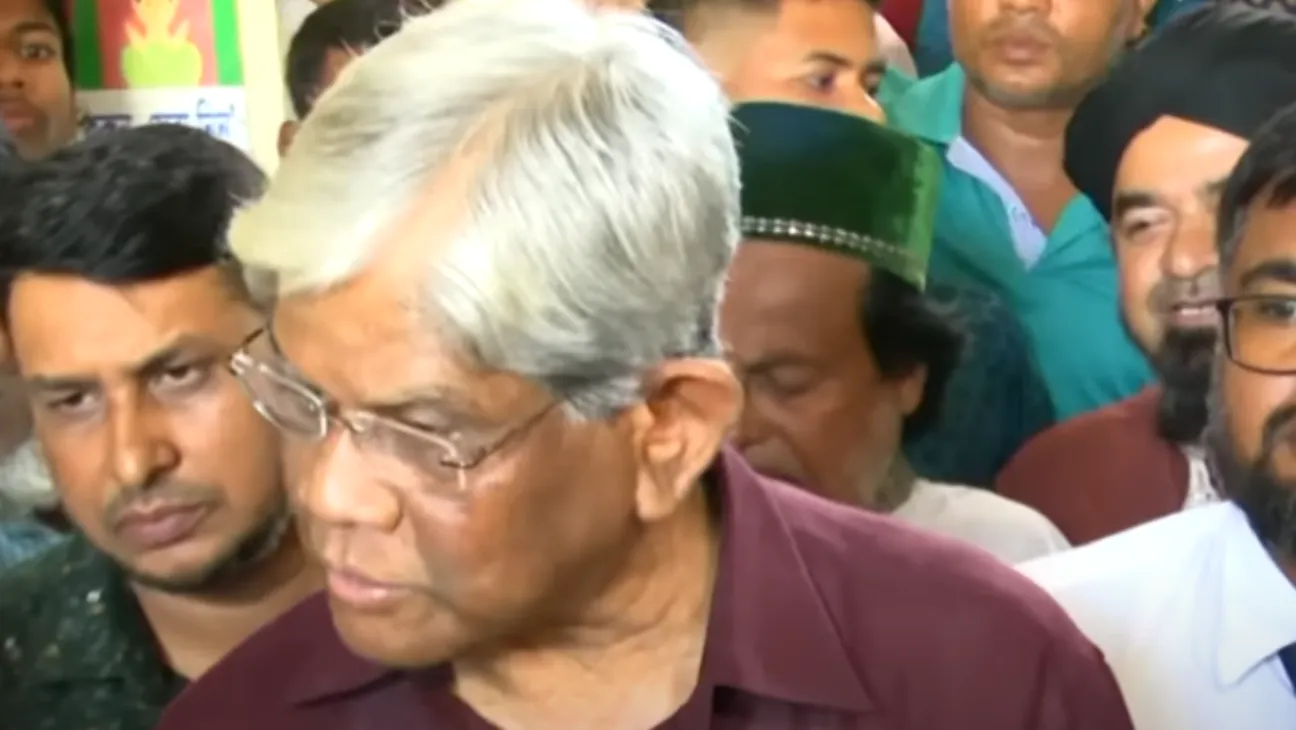

Finance Adviser Salehuddin Ahmed said on Saturday that Bangladesh’s interim government lacks the capacity to carry out structural reforms in the country’s troubled banking sector.

The comments came during a media briefing in Nabinagar upazila of Brahmanbaria after a meeting with government officials.

“Reform in the banking sector is a time-consuming process. It is beyond our capacity,” he said.

“The elected government will have to handle this after taking office.”

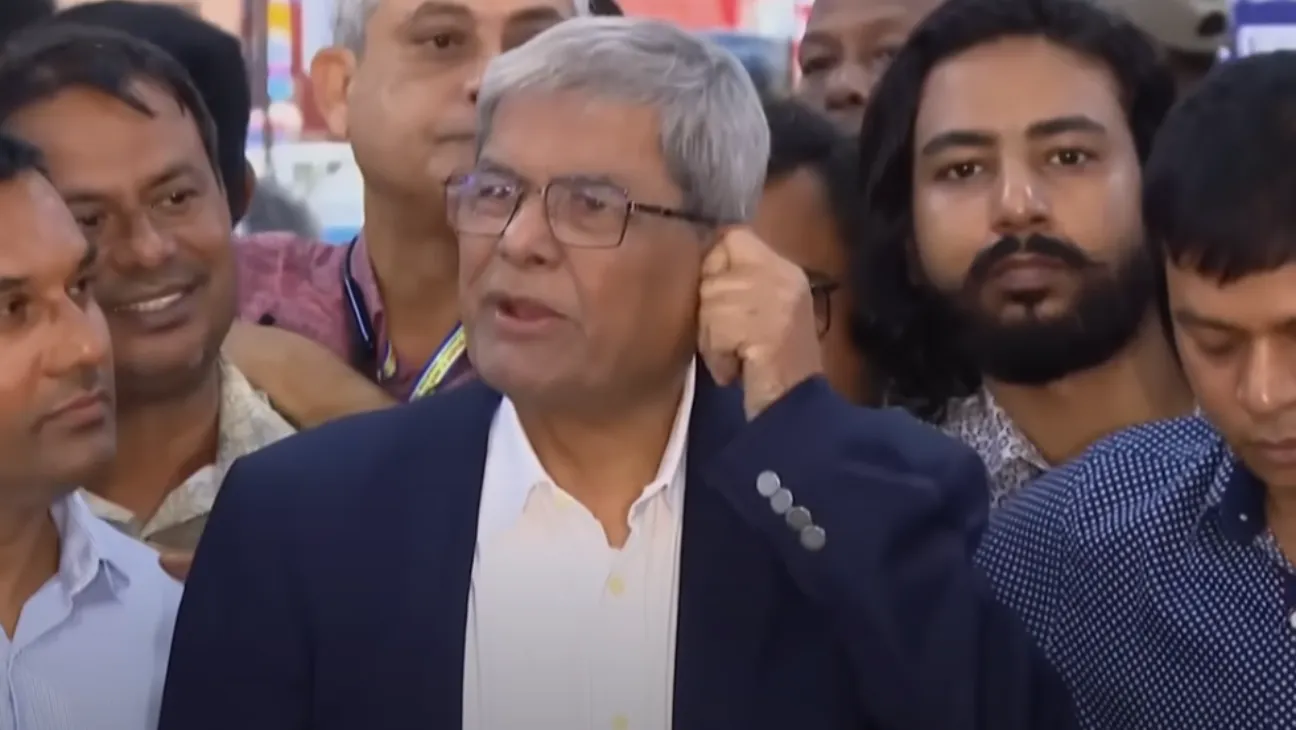

Massive Bailouts for Failing Banks

Ahmed, a former governor of Bangladesh Bank, said the interim administration has injected Tk 52,000 crore into 12 financially unstable banks to maintain stability. He noted this was in addition to Tk 22,000 crore already provided earlier.

“We’re doing our best, but it feels like the issue can’t be solved entirely within our borders,” he said.

He blamed the former government for inflicting major harm on the economy.

“Many top officials and leaders siphoned off huge amounts of money. It’s rare to see this scale of looting anywhere in the world,” he said.

Liquidity at Risk, Savings Certificates a Concern

Ahmed expressed concern about the delicate balance between interest rates and liquidity in the banking system.

“If we raise the interest rate on savings certificates, everyone will buy those. Banks would then lose deposits, creating a liquidity crisis,” he explained.

“How will banks meet their financial obligations if that happens?”

He also referred to the ongoing attempts by Bangladesh Bank to support struggling institutions.

“Islami Bank is just one example. The central bank is working to rehabilitate weak banks,” he said.

New Law Promises to Protect Depositors

According to Ahmed, the government has enacted the Bank Regulation Act. The law includes provisions to safeguard depositors’ money.

“Under the first clause of this act, the government is committed to returning funds to depositors of any troubled bank,” he said.

While avoiding a timeline, the finance adviser said genuine reform hinges on the next elected administration.

For now, the stopgap government is focused on stabilizing the system, not overhauling it.